Please see the disclaimer at the bottom of this blog before using this resource to inform your business decisions.

Starting or running a private practice is a deeply personal and rewarding journey. You’ve spent years studying, training, and dedicating yourself to helping others — but chances are, your education didn’t include courses on business structures, taxes, or liability protection.

Yet, choosing the right business structure is one of the most important financial and legal decisions you’ll make as a private practice owner. It affects how you pay taxes, protect your assets, and plan for growth. Unfortunately, it can also feel overwhelming — especially when you’re already balancing client care, paperwork, and the emotional demands of therapy work.

The good news? You don’t have to be a business expert to make a smart choice. This guide breaks down the three most common business structures for Canadian therapists:

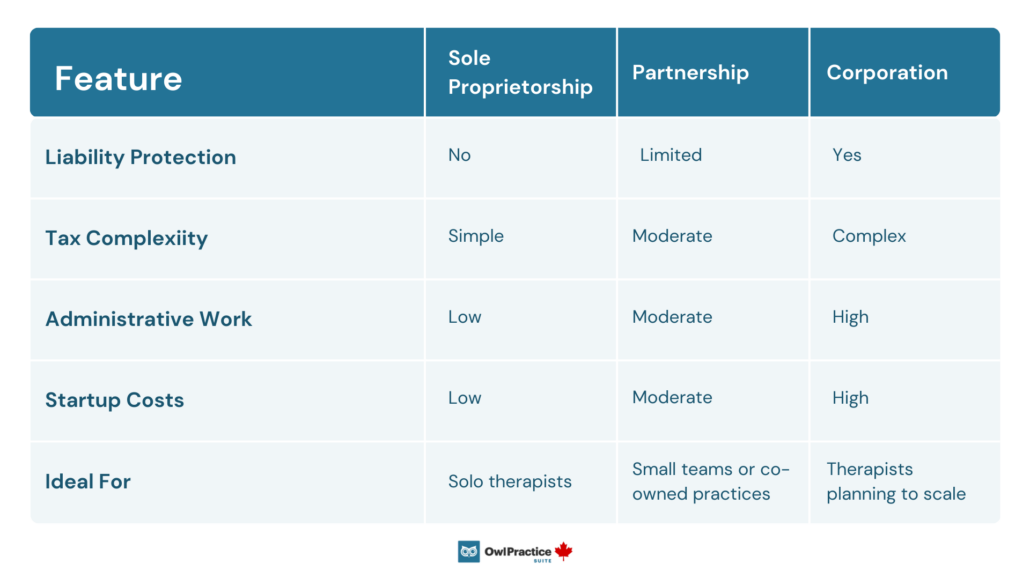

- Sole Proprietorship – The simplest, most affordable option but with personal liability risks.

- Partnership – A structure for two or more practitioners working together.

- Corporation – A legal entity that provides liability protection and tax advantages but comes with additional costs and administrative requirements.

By the end of this guide, you’ll have a clearer idea of which structure aligns with your financial needs, risk tolerance, and long-term practice goals — so you can make an informed, confident decision.

Key Factors to Consider When Choosing a Business Structure

You don’t need to become a legal expert overnight, but it helps to understand a few key areas when choosing how to structure your private practice. Let’s break it down:

1. Liability Protection

If something goes wrong — whether it’s a lawsuit, unpaid debt, or unexpected business crisis — your business structure determines whether your personal assets (like your house, car, or savings) are at risk.

- Sole Proprietorship – No separation between you and your business. If your practice is sued, your personal assets are vulnerable.

- Partnership – Similar to a sole proprietorship but shared among partners. Partners can be personally liable unless a limited partnership is in place.

- Corporation – Your business is legally separate from you, protecting your personal assets from lawsuits or debts. Depending on your province or territory, certain professionals may be able to form a professional corporation. Note that in choosing this option, you may need to be aware of both clinical and corporate liability. Clinical liability refers to the legal responsibility you have for the care you provide your clients. This includes issues like malpractice and negligence. Corporate liability refers to an organization’s legal responsibilities for its policies and business operations. This includes being responsible for your employee’s actions at word, compliance violations and employment law.

2. Tax Implications

Understanding how your business structure affects your taxes is essential for managing your finances effectively.

- Sole Proprietorship – You report all business income on your personal tax return (T1 form) and pay self-employment taxes, including CPP contributions.

- Partnership – Similar to a sole proprietorship, with income shared between partners and taxed individually.

- Corporation – Business profits are taxed at the corporate tax rate (often lower than personal income tax rates), and owners can take a salary or dividends to optimize taxation.

3. Administrative Requirements & Costs

Some structures are low-maintenance, while others require more paperwork, fees, and legal compliance.

- Sole Proprietorship – Easiest to set up, little to no paperwork required beyond business registration.

- Partnership – Requires a partnership agreement and registration but remains relatively simple.

- Corporation – Must register with the federal or provincial government, file annual corporate tax returns, and maintain records of financial transactions and meetings.

4. Flexibility & Scalability

Think about where your practice is now and where you want it to be in 5-10 years.

- Sole Proprietorship – Best for solo therapists who don’t plan to hire employees or expand.

- Partnership – Great for practices with multiple therapists who want to share resources. However, you may want to consider planning for the event that a partner wants to leave the partnership, or transition the practice when exploring this option.

- Corporation – Ideal for therapists planning to scale their business, hire staff, or open multiple locations.

5. Provincial and Federal Regulations

Business structures in Canada are regulated differently depending on your province or territory.

- Some provinces require additional licensing for therapy practices.

- Corporate tax rates and registration fees vary by province.

- Sole proprietorships and partnerships may need to register their business names if operating under anything other than the owner’s legal name.

Sole Proprietorship: The Simplest Option

What It Is

A sole proprietorship means you and your business are legally the same. It is the default business structure when you start a private practice without formal registration. The business is legally tied to you — all income, debts, and liabilities belong to you personally. You don’t need to file separate business taxes, and there’s no extra paperwork beyond any necessary therapy licenses or permits.

Pros & Cons

✅ Easy & cheap to start – No formal registration required beyond business name registration.

✅ Full control – You make all the decisions without a board or partners.

✅ Simple tax filing – Report business income on your personal tax return.

❌ No liability protection – Personal assets are at risk.

❌ Harder to get business loans or funding.

❌ Higher personal tax rates on all income.

Partnership: A Collaborative Approach

What It Is

A partnership is when two or more people own a business together. There are two types:

- General Partnership – All partners share liability and management responsibilities.

- Limited Partnership – At least one partner has limited liability, reducing personal risk.

Pros & Cons

✅ Shared financial burden and decision-making.

✅ More flexibility than a corporation.

✅ Profits and losses are shared among partners.

❌ Partners are personally liable for debts and legal actions (unless limited liability is in place).

❌ Disputes between partners can complicate operations.

Corporation: The Tax-Efficient and Protected Choice

What It Is

A corporation is a legal entity separate from its owners. This structure provides liability protection and tax advantages but requires more administrative work.

Pros & Cons

✅ Protects personal assets from business liabilities.

✅ Tax benefits – Lower corporate tax rates, ability to pay owners in dividends.

✅ More credibility and access to business loans.

❌ More paperwork and legal requirements.

❌ Higher administrative costs.

❌ Requires separate corporate tax filings.

Comparison Table: Sole Proprietorship vs. Partnership vs. Corporation

Final Steps: Speak with a Professional

While we hope that this blog serves as a helpful resource to showcase your options for business structures for your private practice, we know that this is a big decision. Before starting the hard work that is officially setting up your business, please take the time to speak with the right professionals. Consultations with an accountant, lawyer, banker or business consultant could provide you with specific information that is the best fit for you and your goals.It’s also important to consult with your province, territory and college resources to ensure that you are abiding by the right policies and regulations. You might also want to leverage insurance providers for your profession and take advantage of their resources and any consultations they might be able to offer.

Choosing What’s Right For You and Your Practice

It’s completely normal to feel overwhelmed by these decisions — after all, you trained to be a therapist, not a business owner! But just like therapy itself, this is a process of discovery, learning, and growth.

Consider these four questions as you navigate through your options:

- Assess your liability risk – Do you need protection from lawsuits?

- Consider tax implications – Are self-employment taxes a concern?

- Factor in administrative work – Do you want minimal paperwork?

- Think about growth – Will you expand or hire employees?

If you’re just starting out, a sole proprietorship might be the easiest way to begin. If you’re working with others, a partnership could be a good fit. If you want to protect your personal assets while optimizing taxes, a corporation may be worth considering.

There’s no one-size-fits-all answer. The best structure is the one that fits your unique goals, comfort level, and long-term vision. If you’re unsure, don’t hesitate to consult an accountant or business attorney for guidance.

Disclaimer: The information provided in this blog post is for general informational purposes only and should not be considered legal, financial, or tax advice. Business structures, liability protections, and tax regulations can vary by province, territory, and individual circumstances. While we strive to provide accurate and up-to-date information, laws and regulations may change, and the applicability of certain provisions may depend on your specific situation. Before making any decisions regarding the structure of your private practice, we strongly recommend consulting with a qualified accountant, business attorney, or other relevant professional who can provide guidance tailored to your needs. Additionally, be sure to check with your provincial or territorial regulatory body and licensing board to ensure compliance with all applicable laws and professional requirements. Owl Practice and its affiliates are not responsible for any actions taken based on the information in this post. Use of this content is at your own discretion.

Helpful Resources

- Canada Revenue Agency (CRA) – Business Tax Guide

- Owl Practice – Resources for Building Your Practice

By taking the time to make an informed decision now, you’re setting your practice up for long-term success and sustainability — so you can focus on what really matters: helping your clients thrive.

Are you a new practice? Start with Owl.

Reduce clinical administrative tasks and transform more lives with Owl Practice. Owl Practice provides all the tools you need to make your practice successful. Join the thousands of care professionals using Owl to run their practice every day.