When mental health professionals start their practices, many aren’t quite prepared for the enormity of tasks required to run a small business. You’ve spent years training to become therapists, but that doesn’t mean you have the experience needed to create an operating budget for their private practice! There are so many other things that need to be taken care of in addition to your clients, including taxes, staff, billing, utilities, and much more.

If you want to build your private practice into a success, you’re going to need more than just your passion for helping people. You’re also going to need to make yourself into an adaptive small business owner who’s ready to build the best practice possible. And your first step is to come up with a budget!

Why Do You Need an Operating Budget?

An operating budget is at the very foundation of any business.

Simply put, this is a weekly, monthly, quarterly, or annual outline of the money you’re bringing in (revenue) and where you’re spending it (expenses). Having a budget allows you to track your business financially, empowering you to plan and make business decisions much more effectively.

If you’ve never created a budget for a small business before, you might want to consider hiring a professional accountant or bookkeeper to help. If you wish to go at it alone, however, there are a few things that you’ll need to know.

What Do I Include in My Budget?

Revenue

The first thing you want to have in your budget is your estimated revenue. This is the money your private practice is bringing in through your clients. If you’re a new practice, you might not have a ton of money coming in, but that’s okay—expected, even. You’re just getting started, after all.

If you already have several clients, then estimating your revenue should be much easier. You can look at your records over the last financial period and use those as a guide. Finding these records is simple if you already use Owl Practice, as we track all client invoices through our platform.

Expenses

Next, you want to figure out your costs, or expenses. These usually break down into three types: fixed, variable, and isolated costs.

Fixed costs are costs that are not dependent on the level of goods or services produced by a business. They’re also often recurring. For instance, your practice’s rent, electricity, internet, Owl Practice subscription, insurance, and other utilities are all fixed costs. These are usually easy to predict as they’ll likely be close to the same amount every month.

Variable costs are costs that change as the number of goods or services that a business produces changes. These costs will likely impact your practice less than many other small businesses, as you probably don’t need to purchase components for your products and services.

Isolated costs are one-offs. These are things that you pay for once and don’t need to think about again. For example, maybe you need a new printer for your office, or maybe you’d like a comfortable chair.

Cash Flow & Profit

Your cash flow and profit are the “fun” parts of your budget. Your overall cash flow is the net amount of cash and cash equivalents being transferred into and out of your business. Obviously, you want that number to be positive! Your profit is what you’re left with once you deduct your expenses from your revenue.

Ways to Make Budgeting Easier

One of the ways we help Canadian mental health professionals is by providing tools that help them better manage the financial side of their practice.

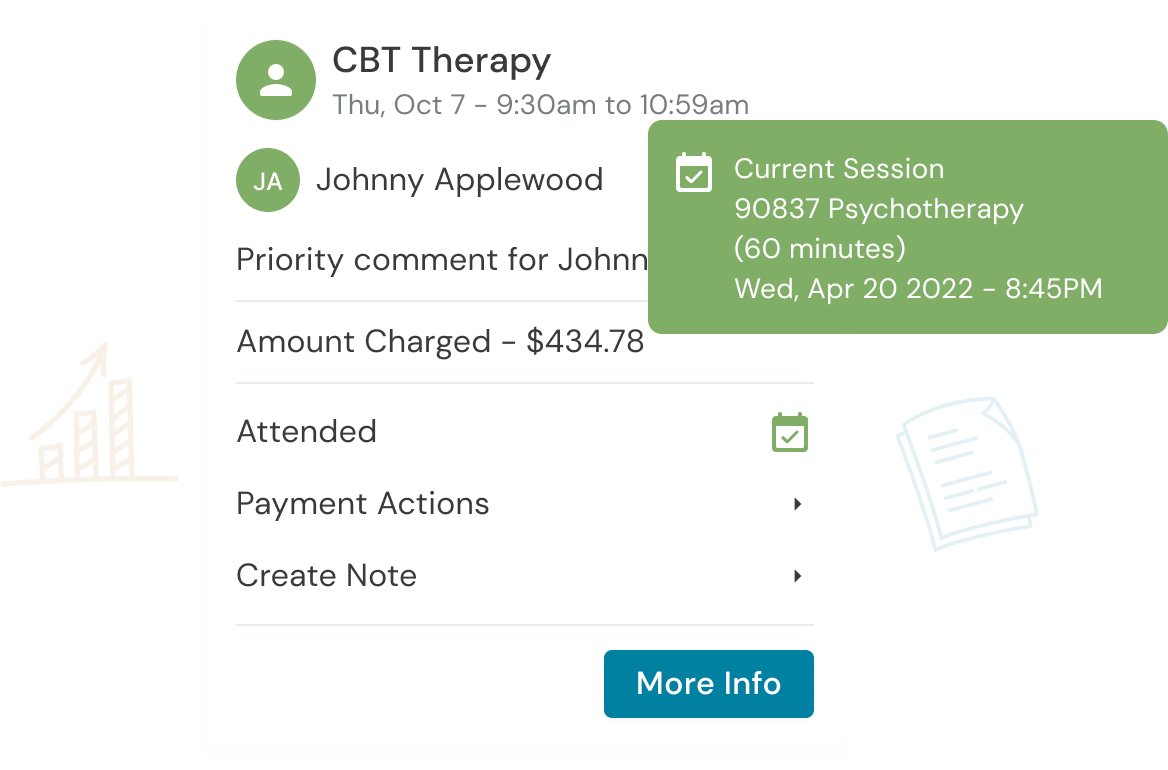

With our invoicing and payment features, you can easily keep track of who’s paying you for what. These invoices are automatically created and sent after each client session, and your clients can pay from within Owl using Stripe. You can then check your key practice stats on your dashboard. Having all this information close at hand is invaluable, especially if you’re working with a bookkeeper and/or accountant to create a budget for your practice!

Every small business is different, and that’s especially the case for a private mental health practice. We’ve designed our practice management tools to help mental health professionals effortlessly run their small businesses, and assisting in helping them create a budget is just one part of that!

If you’d like to learn more about how Owl Practice can help you manage the small business side of your practice, we invite you to sign up for a free trial! If you have any other questions or comments about our services, please contact us at support@owlpractice.com.

As Always,

Practice Wisely

Get paid with Owl Practice.

Reduce clinical administrative tasks and transform more lives with Owl Practice. Owl Practice provides all the tools you need to make your practice successful. Join the thousands of care professionals using Owl to run their practice every day.