I often encounter practice owners who said they grew their practice and didn’t get any formal education on how to manage the business let alone the financial side. Part of my role as a fractional CFO of several group practices is to educate and close the knowledge gap around managing practice finances. I want to share more on how we utilize data to make informed decisions, shift gross margins, and drive profitability for the practices we support.

We will cover making the critical considerations between insurance or private pay, how to establish competitive rates, what compensation structure to consider for your practice, and how to drive weekly accountability to ensure you stay on track to your profit goals and overall practice success.

Insurance or private pay

This decision might be easy at first as you decide which type of practice you want to have. Shifts in the economy or other environmental aspects make you reconsider if insurance-based is the way to go if you are not already an insurance-based practice.

For private pay-based practices

The rates can be higher and competitive with the market, and it works well for highly specialized services and assessments. Often in a hard economy, these types of practices will struggle with growth and will need to invest more heavily in marketing to reach the right client that is willing to pay for services.

For insurance-based practices

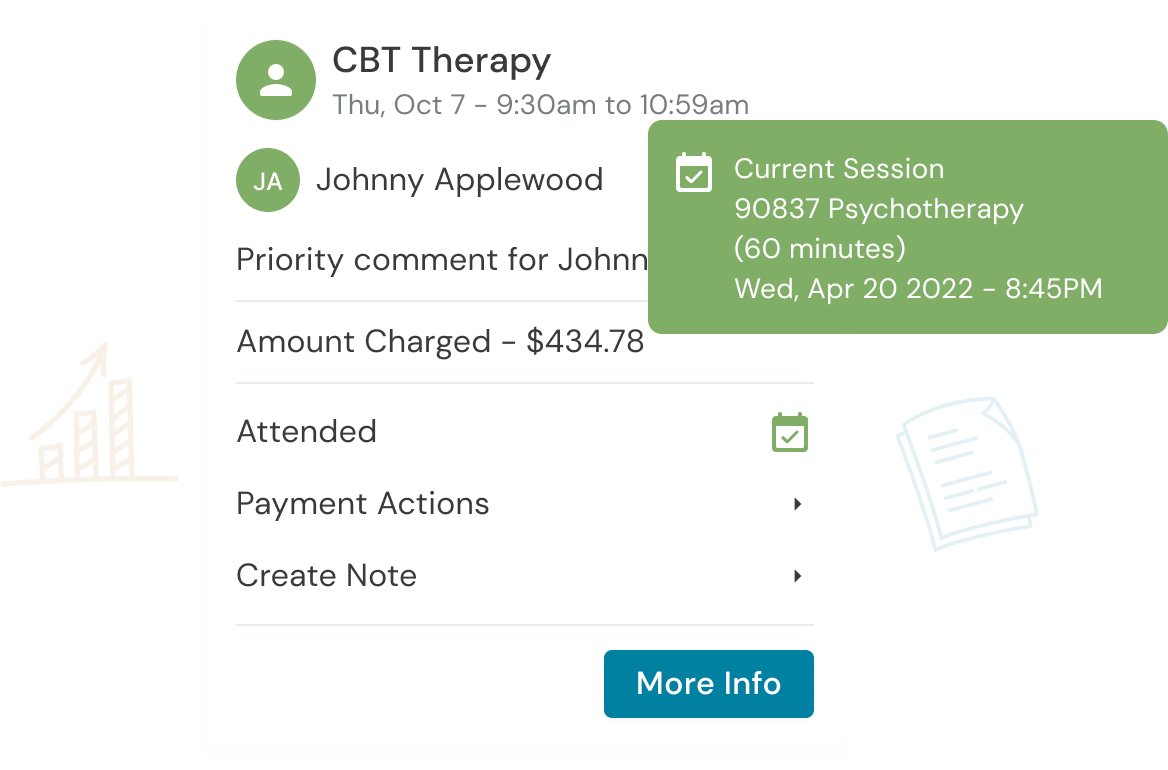

This broadens the amount of leads and removes some of the friction from cash pay clients, but the billing team costs and support while dealing with insurance companies can create some stress in the practice cashflow if not managed carefully. Credentialing sometimes can create delays and issues to get your clinicians to their full capacity. This is more of a volume play as you are not getting paid as much, and it takes time to receive payment from the insurance company while you still must cover payroll costs when the sessions happen. Having a cash runway is key to ensuring you can weather the ups and downs as well as having a robust billing team in place either in-house or outsourced. Regardless of private pay or insurance based, let’s discuss how to set your rates to ensure you have profit in the practice.

In both kinds of practices

Reviewing your accounts receivables or balance outstanding amounts will be key to helping manage the payment collection process and avoiding delays in cashflow hitting the bank.

Establishing competitive rates

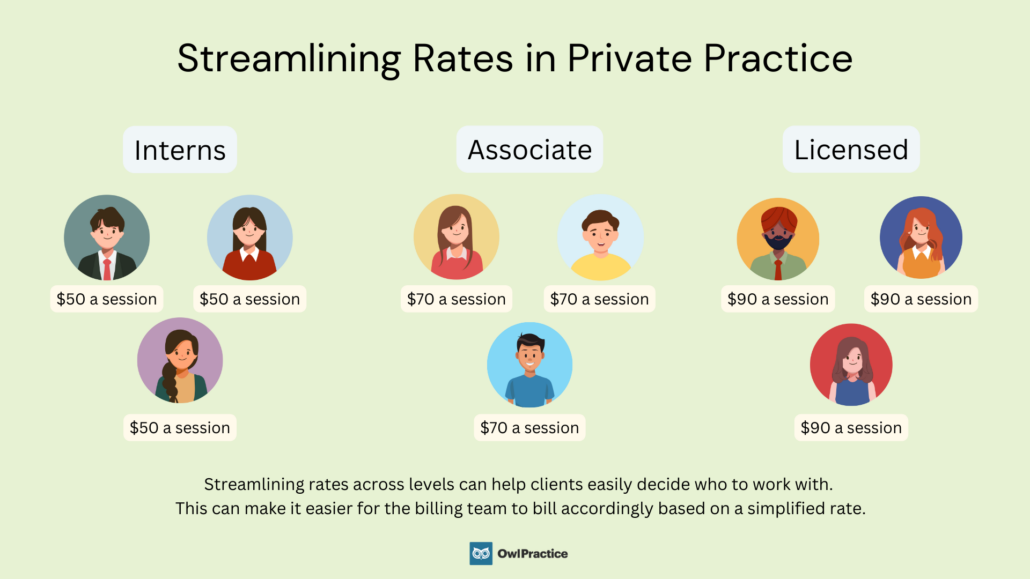

When working with practices there is often a complex matrix of rates that we review to assess if there is an opportunity to streamline. We don’t necessarily want people to choose their clinician based on rates, but instead give them similar options to choose from based on fit and experience level. Streamlining rates across levels such as intern, associate, licensed can help clients easily decide who to work with and make it easier for the billing team to bill accordingly based on a streamlined pricing structure. A similar situation with insurance, as I often see practices under-billing and not increasing their rates even if reimbursements won’t come back higher. We always want to bill high enough to not leave money behind.

We revisit rates yearly and do a 6-month competitive analysis to ensure we are keeping up with market trends. It is important to watch what other practices in the area are doing – not to match it – but to understand how their offers are similar or different and compare rates. Remember that your clients are calling around to find out what is being offered and at what rate. Now that we have addressed rates and expected reimbursements, we can now focus on how to best compensate your clinical team.

Compensation structures

- Commission percentage – Split percentages are a way to connect the clinician’s performance to business performance, but this doesn’t allow for the practice to benefit from the additional margin a clinician could create if they can handle a higher caseload. It is also more challenging to increase their wages as this is a fixed and at some point, the percentage will not feel like enough pay if everyone else around them is getting pay increases.

- Hourly – This structure works well for new clinicians joining the practice as they are getting their caseload to full capacity. Once they have consistently demonstrated they can maintain their clients, you can consider a base salary + commission structure or a base + profit sharing option.

- Salary – We recommend a salary option for the leadership team that has proven track record of results, high self-accountability with clearly defined key performance indicators. These positions should be invested in to help grow the group practice, helping produce, and maintain results from either a clinical director position or practice manager role. The owner should be on salary and ideally removed from clinical work.

It is important to strike a healthy balance and perform the financial projections to ensure you can cover the cost before making compensation changes. Let’s talk about team performance and how to foster accountability to ensure everyone is contributing to the practice’s overall success. These compensation structures should be clearly tied to success metrics such as weekly clinical sessions – this is why accountability is a key component that needs to be actively managed.

Weekly accountability

Regularly check-ins, coaching, and conversation are necessary to manage clinical capacity within the team. Setting weekly, quarterly, or yearly session goals and clearly communicating that expectation to each clinician will be critical in the practice’s success. There should be a weekly review on session count to ensure everyone is meeting their goals. On the flip side, making sure you have enough intakes and leads so you can meet your group practice capacity is an essential aspect of managing margins. The weekly clinical sessions become a leading indicator of revenue, which is a lagging indicator. If you can manage this front end, the revenue and cashflow will flow into the business.

Working towards driving profit in your business

To wrap it all up, managing group practice finances can be complex given all the moving pieces but once you understand the connection between each component, you will be able to easily manage and adjust to drive profit in your business. No one aspect will help you become profitable but focusing on hitting 50-60% gross margins, which is revenue minus the cost of delivering the services (i.e. clinician compensation) divided by revenue, will give you enough room to cover operating expense, pay yourself, and have profit left in the business to reinvest in growth and take home some additional owner’s draws. If you need support working on the finances of your group practice, we are here to help.

Reduce clinical administrative tasks and transform more lives with Owl Practice. Owl Practice provides all the tools you need to make your practice successful. Join the thousands of care professionals using Owl to run their practice every day.