Running a private mental health practice requires not only clinical expertise but also effective financial management. Accounting is a crucial aspect of maintaining a financially healthy practice. In this section, we will explore essential accounting best practices to help mental health therapists manage their private practices efficiently.

1. Separate Personal and Business Finances

It’s a fundamental best practice to keep your personal and business finances separate. Create a dedicated business bank account to ensure clarity in tracking income and expenses related to your practice.

Why it Matters

- Separating finances simplifies record-keeping and helps maintain the financial integrity of your practice.

2. Maintain Accurate Financial Records

Thorough record-keeping is essential for tracking your practice’s financial health. Keep organized records of all transactions, including income, expenses, and tax-related documents.

Why it Matters

- Accurate records facilitate tax preparation and financial analysis.

- Detailed records can help identify areas for cost savings or income optimization.

3. Implement a Budget

Develop and maintain a budget for your practice. A budget helps you set financial goals, manage expenses, and monitor your practice’s financial performance.

Why it Matters

- A budget provides a roadmap for financial decision-making.

- It helps ensure that your practice operates within its means.

4. Regularly Review Financial Statements

Regularly review financial statements, such as profit and loss (P&L) statements and balance sheets. These statements offer insights into your practice’s financial performance and help identify areas that may need attention.

Why it Matters

- Financial statements provide a snapshot of your practice’s financial health.

- They help you make informed decisions to improve profitability.

5. Monitor Cash Flow

Cash flow management is critical. Ensure that your practice has enough cash on hand to cover expenses, including unexpected ones.

Why it Matters

- Managing cash flow prevents financial stress and ensures you can meet your financial obligations.

- It allows you to plan for periods with irregular income, such as vacation time.

6. Set Aside Funds for Taxes

Accrue funds for taxes by regularly setting aside a portion of your income. This practice helps you avoid tax surprises and ensures you have the necessary funds when it’s time to pay your taxes.

Why it Matters

- Setting aside tax funds prevents a financial strain at tax time.

- It ensures compliance with tax obligations.

7. Invest in Accounting Software

Consider using accounting software designed for small businesses or private practices. These tools can streamline financial management, automate processes, and offer features for tracking expenses and income.

Why it Matters

- Accounting software simplifies record-keeping and financial analysis.

- It reduces the risk of errors and offers time-saving benefits.

8. Consult with a Financial Professional

When in doubt or facing complex financial situations, consult with a financial professional, such as an accountant or financial advisor. Their expertise can provide valuable insights and guidance for your practice’s financial health.

Why it Matters

- Financial professionals can help optimize tax strategies, manage investments, and provide financial planning guidance.

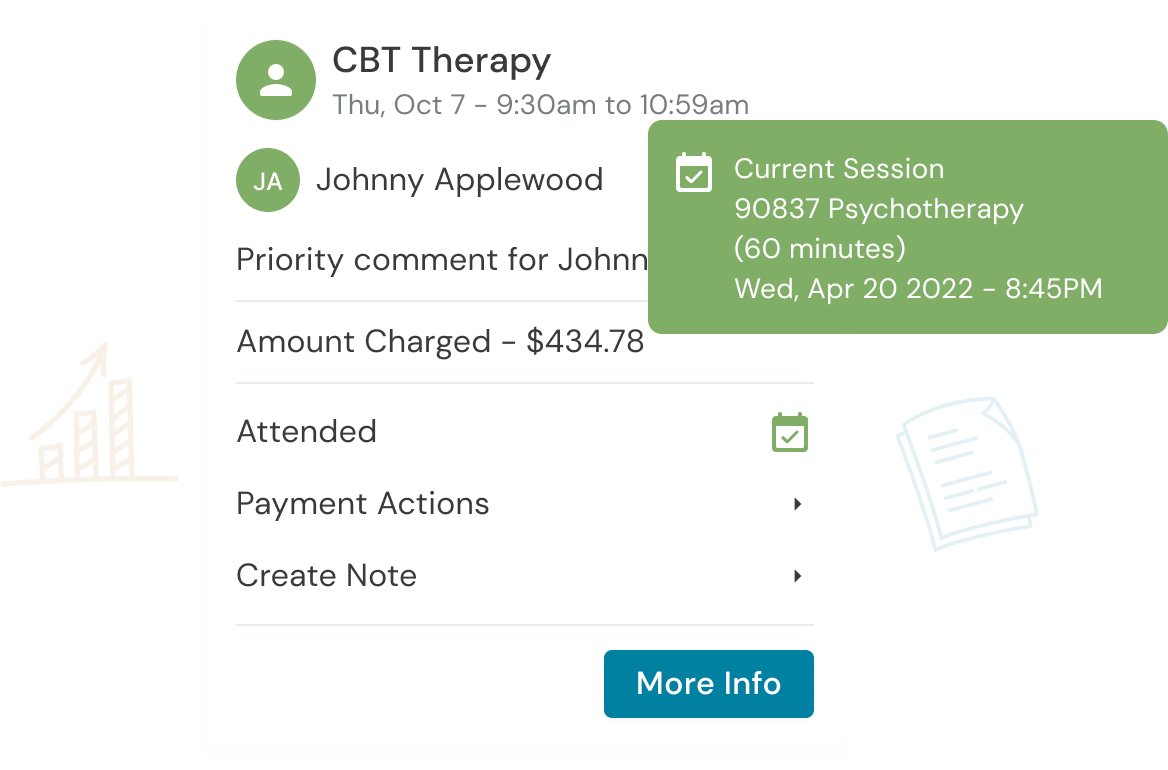

9. Regularly Run Reports

Some EHRs, like Owl Practice, include features that allow you to run reports that will keep your practice healthy. With Owl Payments, you can easily get practice reports and insights that keep you apprised of session attendance, financial documents, billing and client notes. You’ll also be able to see key practice statistics at a glance and monitor your revenue, session volume and more from the Owl dashboard.

Why it Matters

- Putting administrative tasks on autopilot like invoices and receipts, along with other reports frees up your time, and can give you confidence and power in making decisions for your practice.

Summary

Accounting best practices are essential for maintaining the financial health of your mental health private practice.

By following these guidelines, you can create a solid financial foundation that allows you to focus on providing the best possible care to your clients, while also ensuring the long-term success of your practice.

Get the “Ultimate Guide to Navigating Insurance” eBook Below!

Reduce clinical administrative tasks and transform more lives with Owl Practice. Owl Practice provides all the tools you need to make your practice successful. Join the thousands of care professionals using Owl to run their practice every day.