For many people working in the mental health field, running their own private practice is a dream. While many therapists enjoy supporting clients in a space of their own and at their own pace, they soon realize that running a private practice also takes practical planning. One of the ways to actualize running your dream private practice is to build a budget that is sustainable. With a strong budget, you can continue to help clients without stressing about money.

Wondering how you can build the right budget for your private practice? Here are some tips to get you on your way to a financially sustainable private practice, including how to evaluate and enhance your practice’s current budget.

Envision your practice

Before you get into the nitty gritty of building a budget, start by envisioning your dream private practice. What kind of practice do you want to lead? What’s important to include in your practice, and how will your practice embody your therapeutic philosophy? You might also think about what types of clients your practice attracts, and how clients feel after completing another session at your practice. These will be your guiding stars as you make decisions about your practice, including how you earn and spend your money.

After you’ve established what’s most important to incorporate into your practice, you can begin to consider the finer details about how you’ll reach your goals. Not only will you have goals for your practice as a business, but you’ll also have personal goals related to the type of working lifestyle you would like to have. Ask yourself the following questions:

- How many hours do you want to work each week?

- What other priorities will you have outside of this practice?

- What do you want your “work day” to look like, considering that you’ll both be seeing clients and running a business?

Your answers to these questions can help guide how you build your budget. By keeping in mind what’s most important to you in your practice, you can begin to align how you run your practice accordingly.

Determine how much income you need

Now that you’ve established your guiding stars and your preferred work lifestyle, it’s time to get down into the details of your budget – starting with what money you’re earning. Here are a few ways to think about your income.

Therapy hours and session fees

Your income is how much money your practice brings in. The majority of your income will come from two factors: how many hours you work and what you charge per hour.

As you’re evaluating your budget, track how many hours you’re working each week. Next, consider how much you’re charging per session. Multiplying these numbers together will give you your weekly income.

One reason why many therapists are drawn to private practice is because in private practice, they get to make decisions on how many clients they see and how much they charge. You might start by charging clients $100 per session, but change your session fee to $130 should your budget require. While it’s necessary to be transparent and communicative with your clients about fee changes, it’s ultimately your decision how you set up your fee structure. If you find that you want more income for your practice, you can either increase the number of sessions offered or increase your session fee.

Need help calculating your income? You can use our therapy session fee calculator to see what your budget looks like based on how many clients you want to see per day, how many weeks of vacation you want per year, your expenses, and other sources of income. It’s a useful tool as you’re determining your income needs, especially as you’re looking to reach your practice and personal goals.

If you aren’t quite set on setting a one-size-fits-all session fee, you can always offer sliding scale sessions. By reducing your session fee for those with a tighter budget to spend on mental health treatment, you can ensure that you’re still bringing in the money that your practice needs to continue operating while also offering accessible services.

Think about your expenses

Next, after determining your income, it’s time to think about expenses. It’s best to sit down with a trusty pen and paper to list out all of your expenses. You might be surprised how many you can recall off the top of your head. You’ll likely write down the bigger items like office rent, website fees, and record management system subscription costs. You might also remember paying for office decorations and all of the car rides you took to get all of those decorations to your office. Try to add as many items to this list as you can.

Next, move over to your computer. Going through your email and bank statements, what other expenses can you find? Were there any items that you completely forgot about?

See if you can categorize these expenses into those that are regular (i.e. monthly, like rent) or one-off purchases. You’ll need to incorporate all of your regular expenses into your practice budget so you can estimate monthly costs and predict how much income you’ll need. You’ll also use the amount of those one-off purchases to come up with an “extra” budget item for extras and emergencies that you’ll want to incorporate into your budget as padding.

Do you use any marketing products, website builders, or practice management software? It might be helpful to bring together expenses under one account. For example, Owl Practice Suite offers practice photography services, listing on the therapist directory, and practice management – so you’ll only need to keep track of one bill!

You might also want to earmark what expenses can be tax write-offs. These items might be your marketing budget, meals associated with your work, car payments with a company car, or bank fees. They can also be your professional association fees, licensure fees, or continuing education fees! There are so many things that you can include in your taxes to save your practice money, so be sure to keep track of these expenses to give to your accountant during tax season.

Track financial trends in your practice

You now have a good understanding of what’s coming in and what’s going out of your practice budget. It’s time to start up some good budget-keeping habits!

Try to stay organized – while it may seem tedious, being organized by labeling and filing will save you time in the long run (just think about how easy tax season will be if you have everything in the right place!). There are many excellent budget tracking apps out there, so find an app that will help you track your expenses, including functionality so you can upload those elusive receipts. This way, you won’t have to wonder where you spent your money – you’ll have the answer at your fingertips.

You can also use Google Sheets or other software that is helpful for making spreadsheets, running calculations, and more. There are so many great templates to download online, so be sure to look around for what would work best for you.

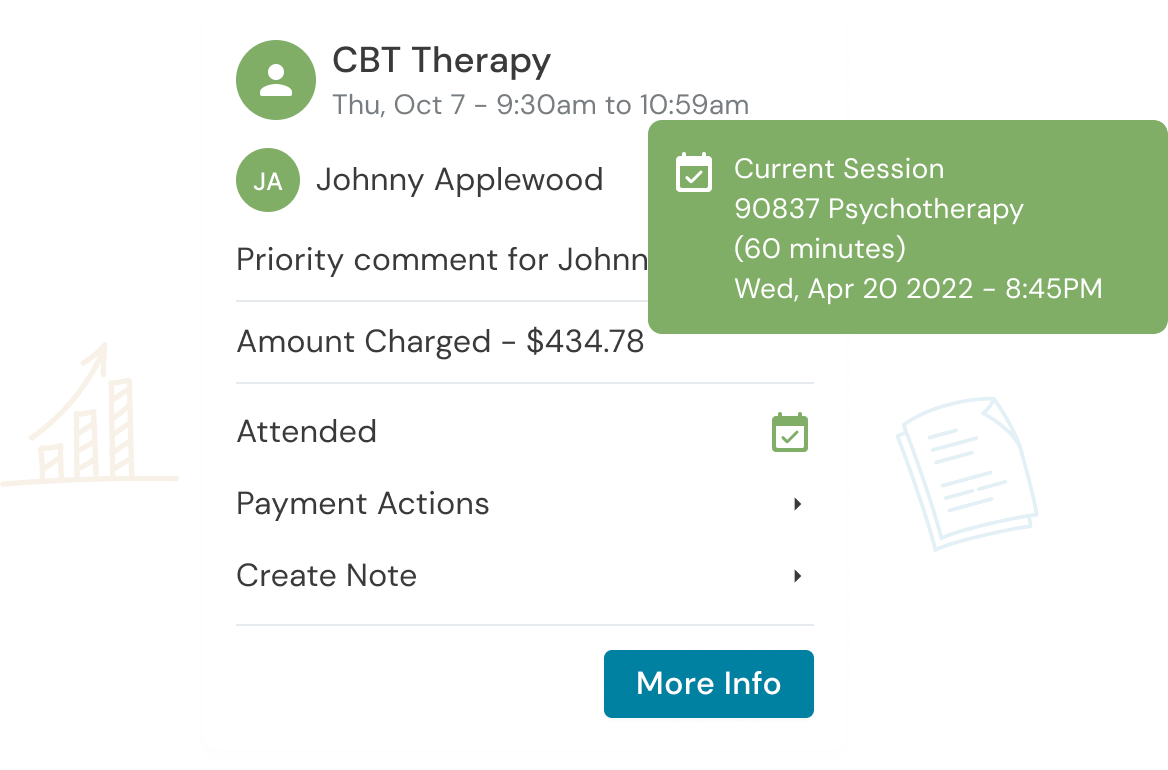

Lastly, try out Owl Practice, which can help you track financial trends in your practice. HIPAA compliant and convenient to use, the Owl Practice platform can process and track insurance claims and create superbills for your out-of-network clients. You can also use the Owl Practice platform to schedule your sessions with your clients, send them forms, and message with them in a secure online space.

Adjust accordingly

Next, adjust your budget as needed. Remember your guiding stars, and what’s most important to you in running your ideal private practice. From this perspective, you can prioritize your spending. By paying close attention to what’s happening within your practice’s finances, you can see what’s benefitting your practice, what’s worth regular expenses – and what expenses you need to start reducing. If some of your expenses come with account management, see if you can ask about a lower rate or reduced services. You might also look around at other products that you could switch to for less expense, like finding a marketing platform that fits your budget.

Remember that your practice can scale as it grows. If you’re just starting out, you might need a few months or even years to reach your goal number of clients, and your goal income. You might start with a second hand couch, but once your budget has a bit more heft, you can buy that pink velvet couch you’ve had your eye on! If your practice is bringing in more income, don’t be afraid to spend more money on the details that make your practice exactly what you dreamt.

We’re so excited to see what your dream practice looks like! Our last tip for you is to be sure to include a line item in your expenses for celebrating your progress as a private practice therapist – you deserve it!

Are you a new practice? Start with Owl.

Reduce clinical administrative tasks and transform more lives with Owl Practice. Owl Practice provides all the tools you need to make your practice successful. Join the thousands of care professionals using Owl to run their practice every day.