In Canada, eTransfers have become a staple for quick payments in daily transactions. People often use them to split bills or settle small debts among friends, and increasingly, small businesses and freelancers are drawn to this fast, convenient payment method. However, for Canadian mental health professionals, using eTransfers to accept client payments introduces serious risks. These transactions, while tempting for their simplicity, fall short of the security and compliance standards required for handling sensitive client information.

This article delves into why eTransfers are risky and non-compliant for therapists, the potential consequences of their use, and alternative payment solutions designed to protect both therapist practices and client confidentiality.

What is eTransfer?

An eTransfer is a type of direct bank-to-bank payment method that relies on email addresses or phone numbers to send funds. Commonly used across Canada, eTransfers enable people to make payments within seconds. This technology is popular for personal transactions and has recently seen a surge in small businesses, including therapy practices, where some therapists see eTransfers as a convenient option for client payments.

For many mental health practitioners, the convenience of eTransfers can be appealing. The fast processing time and simplicity eliminate the need for physical payment systems, which is attractive, especially for practices without integrated payment solutions. However, there are significant downsides to this payment method, particularly in the realm of client privacy and compliance.

Why eTransfers Are Risky for Mental Health Professionals

1. Lack of Privacy and Confidentiality Protections

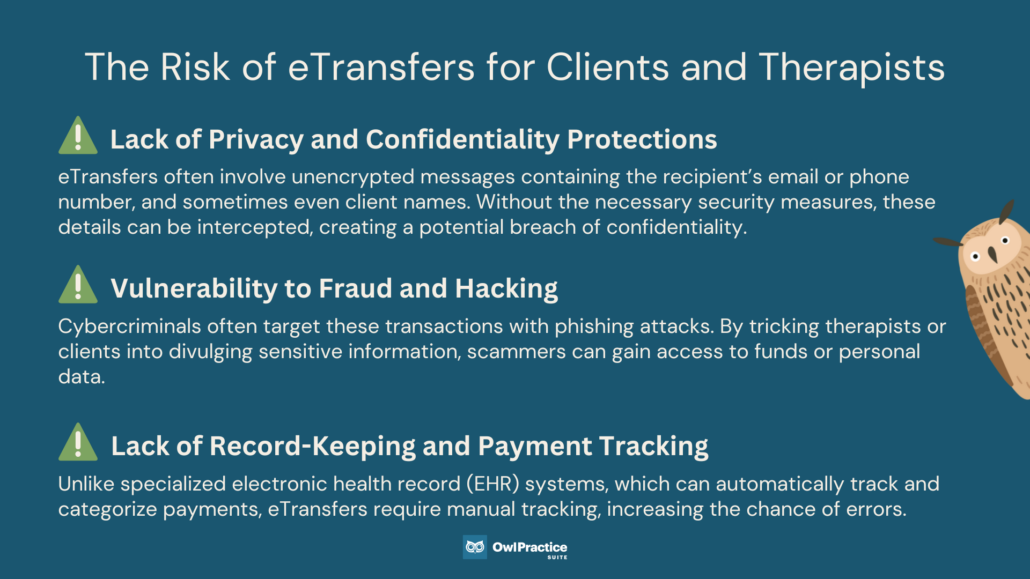

One of the primary concerns with eTransfers is the lack of privacy safeguards. Unlike encrypted platforms designed for handling sensitive information, eTransfers often involve unencrypted messages containing the recipient’s email or phone number, and sometimes even client names. Without the necessary security measures, these details can be intercepted, creating a potential breach of confidentiality. For mental health professionals bound by strict confidentiality agreements, this lack of protection makes eTransfers a risky option.

2. Vulnerability to Fraud and Hacking

eTransfers are particularly vulnerable to fraud schemes. Because they use email and phone numbers, cybercriminals often target these transactions with phishing attacks. By tricking therapists or clients into divulging sensitive information, scammers can gain access to funds or personal data. This risk of fraud or theft can jeopardize not only financial security but also the trust and confidentiality integral to therapist-client relationships.

3. Lack of Record-Keeping and Payment Tracking

A significant drawback to using eTransfers in mental health practices is the lack of a built-in tracking system for payments. Unlike specialized electronic health record (EHR) systems, which can automatically track and categorize payments, eTransfers require manual tracking, increasing the chance of errors. This creates a fragmented payment record, making it challenging to maintain accurate financial documentation and adding unnecessary administrative burden on therapists.

While convenient, eTransfers lack the security, fraud protection, and record-keeping features necessary for a compliant mental health practice, making them unsuitable for handling client payments.

Compliance Issues with eTransfer for Canadian Mental Health Professionals

1. Non-Compliance with PHIPA (Personal Health Information Protection Act)

In Canada, the Personal Health Information Protection Act (PHIPA) mandates that health information, including client names and details linked to therapy, must be protected by strict privacy standards. eTransfers, however, lack the data protection mechanisms required by PHIPA. These transactions expose client data, which means therapists using eTransfers may unintentionally violate PHIPA, risking legal repercussions.

2. Issues with PCI-DSS (Payment Card Industry Data Security Standard)

The Payment Card Industry Data Security Standard (PCI-DSS) is essential for payment processing compliance, particularly for card-based transactions. While not traditionally applied to eTransfers, the lack of equivalent security standards in eTransfer processes means that the level of protection PCI-DSS offers is absent. Without these protections, sensitive client information can be compromised, leading to compliance issues that may impact a therapist’s practice.

Compliance with privacy and security standards like PHIPA and PCI-DSS is non-negotiable for mental health practices, and eTransfers do not meet these requirements, exposing therapists to potential legal risks.

Get paid with Owl Practice.

The Consequences of Using Non-Compliant Payment Methods

1. Legal and Financial Penalties

Therapists who use non-compliant payment methods like eTransfers face significant risks. Non-compliance with PHIPA and other data protection laws can lead to severe legal penalties, including fines or lawsuits. If a client’s confidential information is compromised due to an insecure transaction, therapists may also face substantial financial loss and reputational harm.

2. Loss of Client Trust

Client confidentiality is a cornerstone of the therapeutic relationship. When therapists fail to protect this privacy, clients may lose trust in their provider, affecting the therapeutic alliance. In a field where privacy is paramount, maintaining client trust through compliant, secure payment methods is essential for building lasting client relationships.

Non-compliance can result in serious legal and financial consequences, and it can erode the essential trust between therapists and clients, impacting the long-term success of a practice.

Compliant Alternatives to eTransfers

Integrated Payment Systems in Secure EHR Platforms

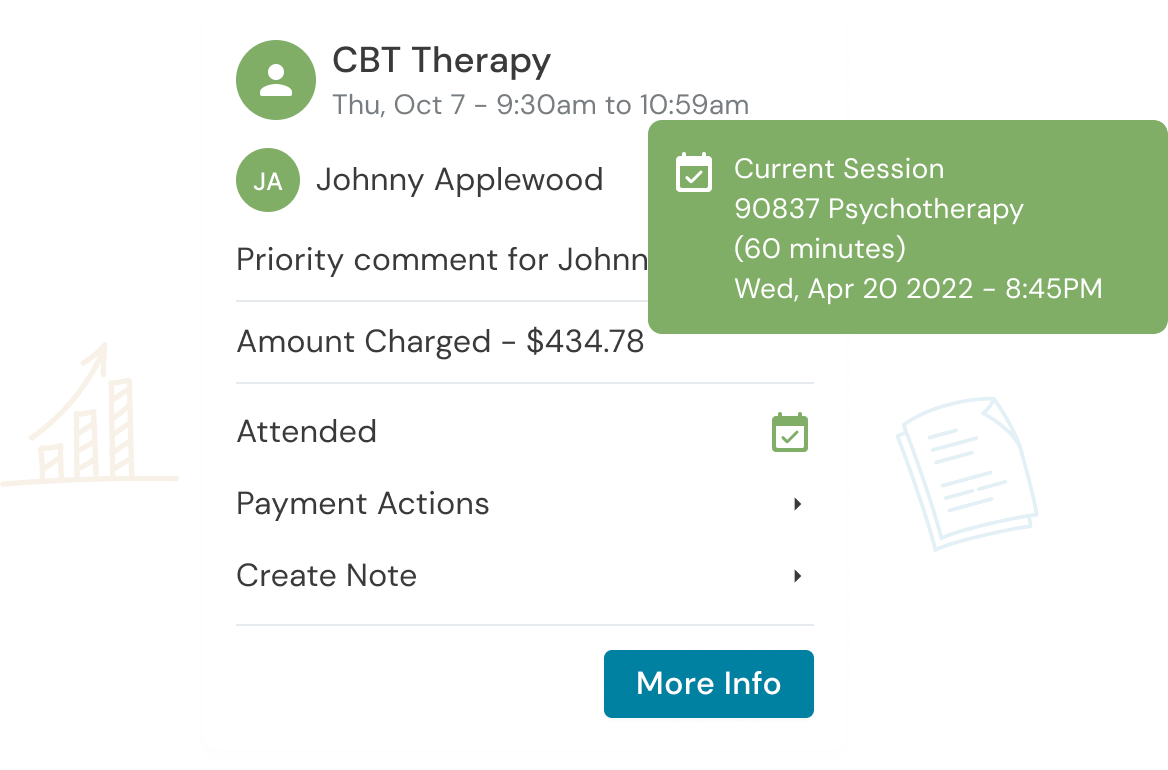

For Canadian therapists, using integrated payment systems within a secure EHR platform is a great compliant alternative to eTransfers. Systems like Owl Practice offer secure payment solutions designed to meet PHIPA and PCI-DSS requirements, ensuring that transactions are encrypted and client information is protected. Owl Practice’s integrated payment features streamline record-keeping, making it easier to track payments, and reducing the chance of errors.

Benefits of Using Compliant Payment Methods

Switching to compliant payment options not only safeguards client confidentiality but also offers significant operational advantages. These systems reduce administrative tasks by automatically tracking transactions within a unified platform, allowing therapists to focus more on client care and less on financial management. The added layer of security and compliance also reinforces the practice’s reputation, showing clients that their therapist values privacy and professionalism.

Compliant payment solutions within secure EHR systems offer both security and efficiency, protecting client data and simplifying financial management for therapists.

Conclusion: Moving Towards Compliance and Security

While eTransfers are popular for personal and small business transactions, they fall short of meeting the strict compliance requirements needed in mental health practices. The risks associated with eTransfers—ranging from potential privacy breaches to compliance failures—pose significant challenges for Canadian mental health professionals. Adopting secure, compliant alternatives like Owl Practice’s integrated payment solutions offers a safer, more efficient way to manage client payments while prioritizing confidentiality and trust.

If you’re a mental health professional seeking to protect your clients and practice, consider exploring Owl Practice’s secure payment options. With solutions designed to meet PHIPA and PCI-DSS standards, Owl Practice is committed to supporting Canadian therapists in running compliant, client-focused practices.

Reduce clinical administrative tasks and transform more lives with Owl Practice. Owl Practice provides all the tools you need to make your practice successful. Join the thousands of care professionals using Owl to run their practice every day.