The administrative aspects of running a mental health practice, including billing and insurance claim submission, can be time-consuming and complex. Automating these processes can save you valuable time and reduce the risk of errors.

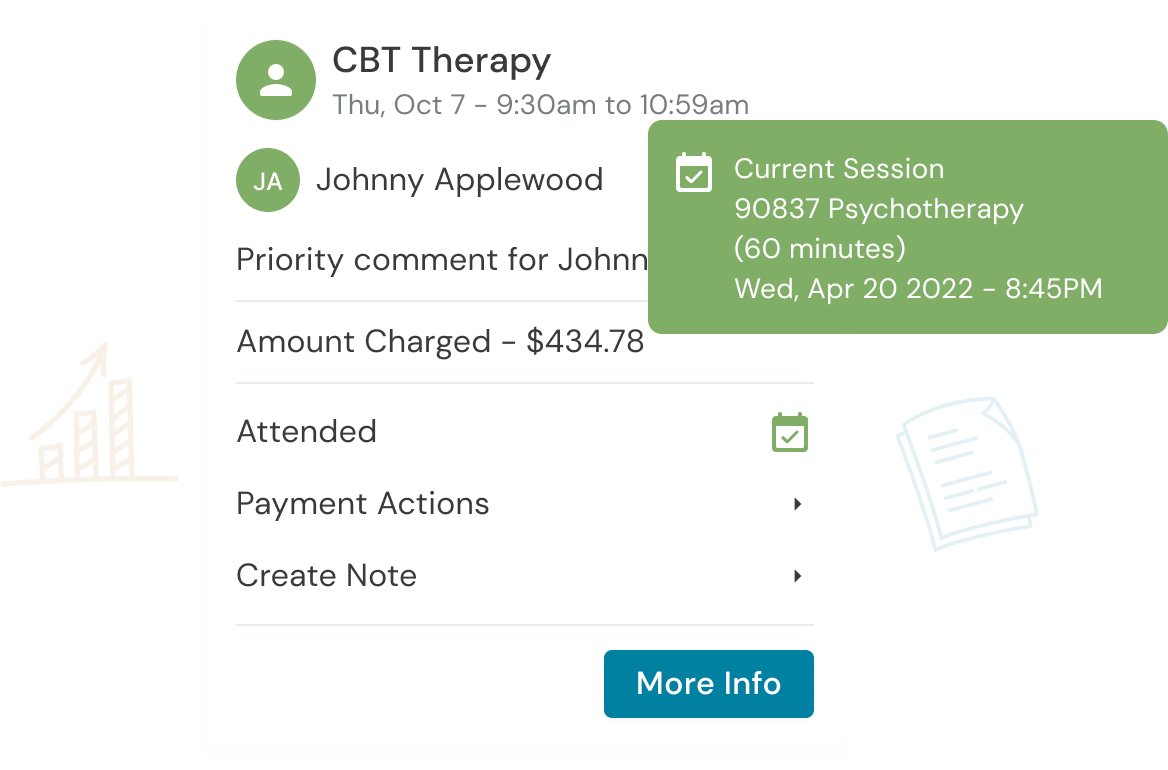

1. Choose the Right EHR (Electronic Health Record)

To automate your billing and insurance claim submission, start by selecting the appropriate EHR. This software should be tailored to the needs of mental health professionals and offer features such as electronic claims submission, appointment scheduling, and client record management.

Best Practices

- Research EHR options that suit your practice’s size and specialty.

- Ensure the EHR complies with HIPAA regulations for data security.

2. Verify Insurance Eligibility and Benefits Automatically

Many EHRs offer the capability to automatically verify a client’s insurance eligibility and benefits. This feature can help you determine the client’s coverage, co-pays, and deductibles without manual verification.

Best Practices

- Utilize the automated eligibility verification feature before each client’s appointment.

- Note: This is not always a free service. If you are limited by cost for eligibility verification, verification is really only needed at major milestones and not every session.

- Train your staff, if applicable, to use this feature effectively.

3. Use Electronic Claims Submission

Transition from paper-based claims submission to electronic claims submission.

This automated process reduces the risk of errors and speeds up the reimbursement process.

Best Practices

- Ensure your EHR supports electronic claims submission to the major insurance companies you work with.

- Verify the approved location and modifier codes, as different insurance companies may have different rules regarding these codes.

4. Set Up Automated Payment Reminders

Automate payment reminders to ensure clients are aware of their financial responsibilities. Most EHRs includes a feature for automated reminders, reducing the risk of missed payments.

Best Practices

- Customize reminders to align with the client’s insurance coverage and billing cycle.

- Schedule reminders at appropriate intervals before and after the session. Implement a no-show policy and automate no show charges.

5. Implement a Secure Payment Option

Integrate a secure payment gateway into your EHR, allowing clients to pay their co-pays and fees electronically.

Best Practices

- Ensure the payment gateway is compliant with Payment Card Industry Data Security Standard (PCI DSS) to protect sensitive client information.

6. Centralize Client Information

Centralizing client information in your EHR ensures that you have all the necessary data at your fingertips.

Best Practices

- Regularly update and maintain client records to ensure accuracy.

- Implement a system for organizing and storing client documents securely.

7. Train Your Staff and Continuously Update Skills

If you have staff members assisting with billing and claim submission, provide training and ongoing education to ensure they are proficient in using the automated tools effectively.

Best Practices

- Schedule regular training sessions to keep staff up to date with the software’s features.

- Encourage staff to attend relevant workshops or courses to enhance their billing and claim submission skills.

Summary

Automating your mental health practice’s billing and insurance claim submission processes can significantly improve efficiency and reduce the risk of errors. By selecting the right EHR, utilizing automated features, and providing appropriate training, you can create a more streamlined and productive practice that allows you to focus on providing quality care to your clients.

Get the “Ultimate Guide to Navigating Insurance” eBook Below!

Reduce clinical administrative tasks and transform more lives with Owl Practice. Owl Practice provides all the tools you need to make your practice successful. Join the thousands of care professionals using Owl to run their practice every day.