Tax season can be overwhelming for therapists, especially those running private practices. Between tracking expenses, understanding what qualifies as a deduction, and ensuring compliance with tax regulations, the process can feel daunting. Yet, maximizing your tax deductions is crucial — it helps reduce taxable income, ultimately lowering the amount you owe to the IRS.

By identifying and claiming eligible deductions, you can retain more of your hard-earned income and reinvest it into your practice, whether for continued education, better office equipment, or enhanced marketing efforts.

In this guide, we’ll cover essential tax deductions for therapists and how to ensure you’re taking full advantage of these benefits. However, tax laws are complex and frequently updated, so consulting a tax professional is always advisable for personalized guidance.

1. Understanding Tax Deductions for Therapists

What Are Tax Deductions and How Do They Work?

A tax deduction is an expense that reduces your taxable income, meaning you only pay taxes on the remaining amount after deductions. This can significantly impact your tax bill, making it essential to track all eligible business expenses.

For example, if your therapy practice earns $80,000 annually and you claim $15,000 in deductions, you’re only taxed on $65,000 rather than the full amount.

Business vs. Personal Expenses: What Qualifies?

The IRS and CRA have clear guidelines on what can and cannot be deducted. The key distinction is that a deductible business expense must be:

✅ Ordinary – Common in the field of therapy.

✅ Necessary – Helpful and essential for running your practice.

Examples of deductible expenses:

- Renting office space

- Purchasing therapy supplies

- Paying for business-related technology

- Marketing costs

Examples of non-deductible expenses:

- Personal therapy (unless required for supervision)

- Regular clothing (even if worn to work)

- Commuting costs from home to your office

IRS Guidelines for Self-Employed Professionals

If you are a self-employed therapist, your tax situation is different from those employed by a larger clinic or hospital. Self-employed professionals can deduct many more expenses, including home office costs and insurance premiums. However, these deductions must be documented thoroughly with receipts and invoices to avoid audit risks.

Download your free tax guide!

2. Common Tax Deductions for Therapists

a. Office and Workspace Expenses

- Home Office Deduction – If you run your therapy practice from home, you may qualify for this deduction. However, your office space must be used exclusively for business. The IRS offers two methods for calculation:

- Simplified Method – Deducts $5 per square foot, up to 300 square feet.

- Regular Method – Calculates actual expenses (rent, utilities, property taxes) based on the percentage of your home used for business.

- Rent & Utilities – If you lease office space, your rent, electricity, water, and Wi-Fi expenses are deductible.

- Office Furniture & Decor – Purchases such as therapy couches, chairs, waiting room furniture, and bookshelves are eligible for deductions.

b. Professional Development and Licensing

- Continuing Education – Therapists must complete regular training to maintain licensure. Course fees, textbooks, and conference expenses all qualify.

- Licensing Fees – Any fees for state licenses, renewals, and national certifications (e.g., APA, NASW) are deductible.

- Professional Memberships – Many therapists join professional organizations for networking and legal support. Membership dues for APA, NASW, and AAMFT are deductible.

c. Business-Related Technology and Software

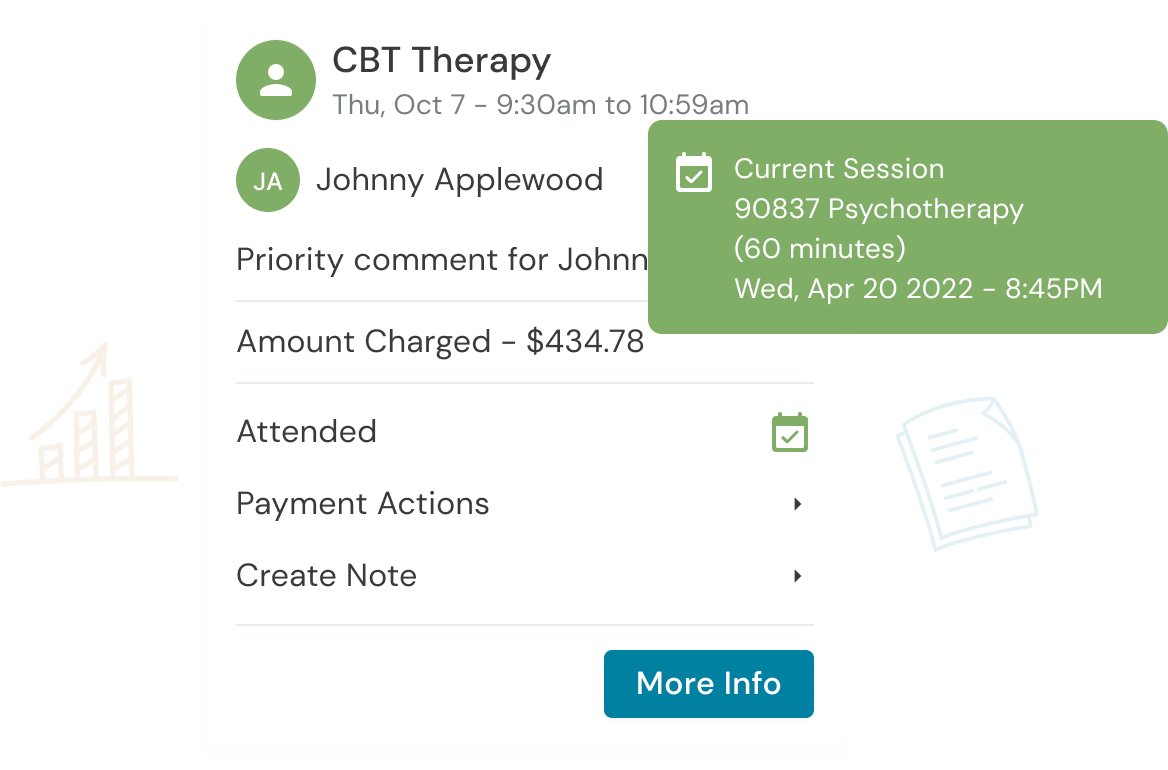

- Practice Management Software – Tools like Owl Practice streamline scheduling, billing, and documentation.

- Telehealth Software – HIPAA-compliant platforms (e.g., Zoom for Healthcare) qualify.

- Website & Marketing Tools – Costs related to domain registration, website hosting, SEO services, and paid advertisements (e.g., Google Ads, Zencare listings) can be deducted.

d. Insurance Costs

- Professional Liability Insurance – Required for many therapists, this insurance protects against malpractice claims.

- Business Insurance – If you rent an office, business insurance covers property damage or liability.

- Health Insurance Premiums – Self-employed therapists can deduct health insurance costs, provided they are not covered by an employer or spouse’s plan.

e. Supplies and Materials

- Office Supplies – Includes pens, notebooks, printer ink, and client folders.

- Therapy Tools – Any tools that enhance client sessions, such as workbooks, therapy dolls, stress balls, or art therapy materials.

- Cleaning Supplies – Disinfectants, hand sanitizers, and cleaning wipes for office maintenance.

f. Marketing and Advertising

- Online Presence – The cost of professional websites, domain renewals, and email marketing tools.

- Paid Advertising – Social media ads, print ads, and business directory listings (Zencare).

- Branded Materials – Business cards, flyers, brochures, and other promotional items.

g. Travel and Transportation

- Mileage Deduction – If you travel for home visits, networking events, or continuing education, you can deduct mileage. The 2024 IRS mileage rate is 67 cents per mile.

- Public Transport & Rideshare – Expenses for buses, trains, Uber, or Lyft used for business purposes.

- Conference Travel – If you attend professional events, costs for airfare, lodging, and meals may be deductible.

h. Employee and Contractor Costs

- Salaries & Wages – If you hire administrative staff or therapists, their salaries are deductible.

- Subcontractor Fees – Payments to virtual assistants, accountants, or billing specialists.

- Payroll Taxes – If you employ staff, you are responsible for Social Security, Medicare, and unemployment taxes.

3. How to Track and Maximize Your Deductions

Keep Detailed Records

Use digital storage for receipts and invoices to maintain organized records. Many deductions require proof of expense, so keeping track prevents issues during audits.

Use Accounting Software

Platforms like QuickBooks, FreshBooks, or Wave simplify tax tracking, automate categorization, and generate financial reports.

Hire a Tax Professional

Working with a CPA ensures compliance with IRS regulations while identifying deductions you may overlook. Tax laws change frequently, so professional guidance helps optimize savings.

4. Common Mistakes to Avoid

❌ Mixing Business and Personal Expenses

- Open a separate business bank account to keep personal and business transactions distinct.

❌ Not Keeping Receipts or Documentation

- Keep digital records of all receipts to avoid losing important proof of expenses.

❌ Overlooking Small Expenses

- Even minor costs (like therapy tools or office decor) add up over time — don’t miss out on these deductions.

Conclusion

Maximizing deductions allows therapists to reduce taxable income and keep more of their earnings. By tracking expenses carefully, using accounting software, and working with a tax professional, you can make tax season less stressful and more financially beneficial.

Staying proactive about your taxes helps your practice grow by freeing up resources to invest in education, marketing, or upgraded technology.

If you have questions about your specific situation, consult a tax expert to ensure you’re claiming every deduction you’re entitled to.

Disclaimer

Owl Practice Suite does not provide tax, legal, or accounting advice. The information provided is for informational purposes only and should not be relied upon as tax, legal, or accounting advice. It is essential to keep detailed records and receipts for all business-related expenses. We strongly recommend consulting with a qualified tax professional or accountant — especially one specializing in small businesses or healthcare practices — to receive personalized guidance, maximize deductions, and ensure compliance with tax laws.

FAQs

Do therapists get tax breaks?

Yes! Self-employed therapists can deduct business-related expenses, reducing their taxable income.

Can therapists write off unpaid invoices?

No, self-employed therapists typically cannot deduct unpaid client invoices as a loss.

Can a therapist write off a therapy dog?

Possibly! If the dog is a certified service animal used in therapy sessions, expenses like training and vet bills may be deductible.

By staying organized and knowledgeable about tax deductions, therapists can save money and run their practices more efficiently!

Get paid with Owl Practice.

Reduce clinical administrative tasks and transform more lives with Owl Practice. Owl Practice provides all the tools you need to make your practice successful. Join the thousands of care professionals using Owl to run their practice every day.