Denied and rejected insurance claims can be a source of frustration and stress for mental health therapists. However, understanding the reasons behind these claim issues and implementing best practices to address them can help therapists streamline their billing processes and minimize financial losses. Below, we’ll explore effective strategies to deal with rejected and denied insurance claims and ensure a smooth reimbursement process.

Thoroughly Review the Rejection

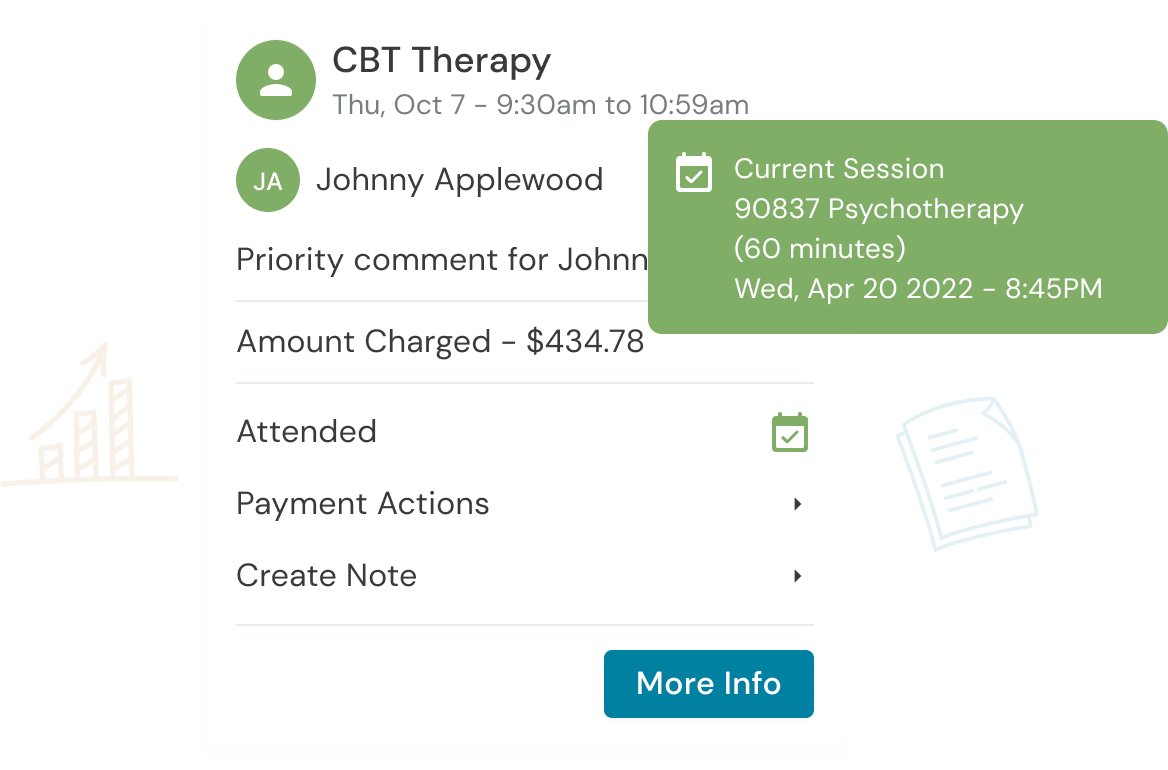

If you are using an EHR, the claim filing tool solution should be reviewing and either rejecting or approving a claim you filed. If you have received a rejected claim, it means that there was something wrong with the claim and the error was caught before it was submitted. This gives you the opportunity to review the claim, fix the errors and resubmit.

Oh No! Your Claim Has Been Denied! What Now?

There are a few reasons why a claim may be denied by insurance. The client is no longer in-network with the therapist, the client might need preauthorization that was not obtained, or policy exclusions.

Steps to Address a Denied Claim

1. Review the denial explanation: Accurate and thorough record-keeping is crucial. Ensure that your session notes are comprehensive to support claims.

2. Contact the insurance company: Confirm with the insurance company that this denial was not made in error, or to discuss the issue.

Helpful Tip:

You can ask the insurance company to refile for you if you believe that it was an error on their part!

3. Correct and resubmit: If the denial was due to missing or incorrect information (that was not caught by your EHR, and therefore not rejected), correct any errors and resubmit. It’s also possible that you might need to provide additional documentation if the denial was due to a question of medical necessity.

4. Appeal the denial: This is your last chance to get your claim approved. Follow the insurance company’s appeals process, which may include submitting a written appeal with supplemental documentation.

Provider Relations Representative

You can investigate if you have an assigned provider relations representative with an insurance company. If you do, keep their information handy in case you have questions about policies or handbooks and contract related questions.

Helpful Tip

- Regularly engage with insurance company representatives to address concerns or questions. Know that you can escalate to a supervisor at any time if you need further assistance.

- Foster a cooperative and professional relationship to facilitate smoother claim processing.

- If you cannot get a response from the insurance company you can contact the insurance commission of your state for advocacy.

- You can also post publicly on the insurance company’s social media, this will get their attention.

Invest in Billing Software or Services

Consider using billing software or services to streamline your claim submission process. Most EHR solutions come with a billing software or service. Such tools can help ensure claims are accurate, reducing the likelihood of denials. Research and invest in billing software that aligns with your practice’s needs. Train your staff, if applicable, on how to use the software effectively.

Summary

Dealing with denied or rejected insurance claims can be a challenging aspect of running a mental health therapy practice. However, with the right strategies and best practices in place, therapists can reduce the impact of denials and rejections and maintain financial stability. Regularly reviewing and updating your billing and documentation practices, staying informed about industry changes, and developing positive relationships with insurance providers can all contribute to a smoother, more efficient reimbursement process.

Get the “Ultimate Guide to Navigating Insurance” eBook Below!

Reduce clinical administrative tasks and transform more lives with Owl Practice. Owl Practice provides all the tools you need to make your practice successful. Join the thousands of care professionals using Owl to run their practice every day.