Unravel the complexities of insurance paneling for therapists and learn how to navigate the world of payors and payments.

What is insurance paneling?

Insurance paneling, also known as credentialing, is the process of becoming an approved, “in-network” provider for insurance companies. It involves submitting an application and supporting documentation to demonstrate your qualifications and expertise as a therapist. This ensures that you meet the requirements set by the insurance company to be eligible for reimbursement.

Insurance Paneling Timeline

- Gather documents like your professional license, malpractice insurance, proof of education and training. Note: some companies require additional documentation, such as proof of business entity formation and office lease! Review the requirements carefully.

- Complete & submit the application. Note that some payors may have different tiers of plan networks you can join—you may have the option to join some or all of these networks.

- Insurance company reviews the application, evaluates credentials, and potentially conducts background checks.

- The review process is complete, the therapist will receive a notification regarding their paneling status.

If a therapist is approved, they will be added to the insurance company’s panel of providers, which means they can start accepting clients who have insurance coverage with that company. Being paneled with insurance companies allows therapists to expand their client base and receive reimbursement for their services, making it easier to sustain a private practice.

What is a payor?

Payors, also known as insurance companies or third-party payers, provide coverage for healthcare services, including therapy, to individuals or groups and play a significant role in the healthcare industry and have a direct impact on therapists’ practices. Understanding who payors are and how they operate is essential for therapists to navigate the complexities of insurance reimbursement and ensure the financial sustainability of their practice.

Payors act as intermediaries between therapists and clients, facilitating the reimbursement process and determining the amount they will cover for therapy services. They have their own policies, guidelines, and fee schedules that therapists must comply with to receive payment. Keep in mind that the fee schedules may be negotiable!

Different payors may have varying requirements, such as pre-authorization for certain services, specific documentation and coding procedures, or limitations on the number of sessions allowed, though since the passage of mental health parity laws, a cap on sessions for mental health care is exceedingly rare. Payors also influence the rates therapists receive for their services. It’s crucial for therapists to familiarize themselves with the policies of each payor they work with and ensure that they follow the guidelines to avoid any payment issues.

Understanding how payors operate and staying informed about their policies and procedures is essential for therapists to effectively manage their practice and ensure proper reimbursement.

How do I get paid?

Therapists deserve to be paid for your services, so learning how to maximize reimbursements and negotiate with insurance companies can help them run a successful therapy practice. By following a few strategies and best practices, therapists can increase their chances of receiving timely and accurate reimbursements from insurance companies.

Best practices for reimbursement

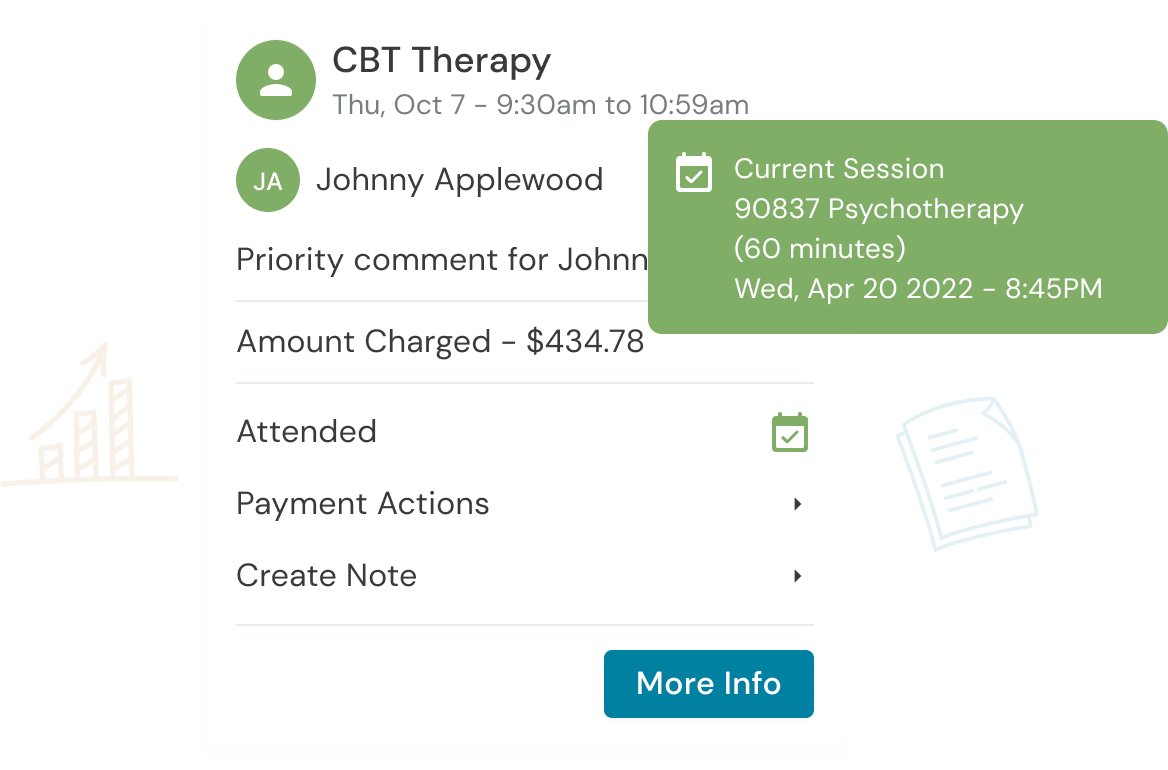

- Documentation — Maintain detailed records of each session, including the date, duration, type of therapy provided, and any additional procedures or interventions. Accurate documentation helps prevent any confusion or disputes regarding the services rendered and supports your reimbursement claims.

- Coding and Billing — Use the correct CPT (Current Procedural Terminology) codes and provide sufficient documentation to justify the services provided. Keeping up to date with any changes in coding requirements is essential to avoid claim denials or delays in reimbursement.

- Tracking Claims — Regularly review and monitor your claims by tracking the status of submitted claims, following up on any unpaid or denied claims, and addressing any errors or discrepancies promptly. By actively managing your claims, you can identify and resolve issues that may impact your reimbursement.

- Reimbursement Policies — Staying informed about the reimbursement policies and requirements of each insurance company, including fee schedules, any limitations or exclusions, and the process for submitting claims. By familiarizing yourself with the specific policies of each insurance company, you can ensure that you meet all the necessary criteria for reimbursement.

- Open Communication — Maintaining open lines of communication with insurance companies is key to maximizing reimbursements. This includes promptly responding to any requests for additional information or documentation and addressing any concerns or issues raised by the insurance company. By establishing a professional and cooperative relationship, you can facilitate the reimbursement process and ensure timely payment for your services.

By implementing best practices, therapists can optimize their reimbursement process and ensure that they receive proper payment for their services. Maximizing reimbursements not only supports the financial viability of your practice but also allows you to continue providing quality care to your clients.

You also have the option to negotiate rates with insurance companies. While insurance companies have their fee schedules, it is possible to negotiate rates to ensure fair compensation for your expertise and the services you provide.

Tips for negotiating rates with insurance companies

- Research and understand the usual reimbursement rates for therapy services in your area.

- Consider joining professional associations or networks that provide resources and guidance on insurance reimbursement.

- Prepare a compelling case that highlights your qualifications, experience, and the value you bring to your clients. If you offer a specialized service or are in an area with a shortage of providers, make sure to highlight these factors.

- Be open to compromise in finding a mutually beneficial agreement.

- Consider discussing alternative payment models, such as bundled services or outcome-based reimbursement, which can provide additional incentives for insurance companies to agree to higher rates.

- Document all communication and agreements during the negotiation process. Having a clear paper trail can help protect your interests and ensure that both parties adhere to the agreed-upon rates.

Negotiating rates with insurance companies may take time and persistence, but it can lead to fair compensation for your services as a therapist. By advocating for yourself and demonstrating the value of your expertise, you can establish a mutually beneficial relationship with insurance companies and ensure that you are appropriately reimbursed.

Deciding whether to panel with an insurance company can have a great impact on your practice. Consider the pros and cons and arm yourself with the knowledge you now have to help you navigate the world of insurance and getting paid.

Reduce clinical administrative tasks and transform more lives with Owl Practice. Owl Practice provides all the tools you need to make your practice successful. Join the thousands of care professionals using Owl to run their practice every day.

Try Owl free for 14 days, no credit card required!

Get paid with Owl Practice.

Reduce clinical administrative tasks and transform more lives with Owl Practice. Owl Practice provides all the tools you need to make your practice successful. Join the thousands of care professionals using Owl to run their practice every day.